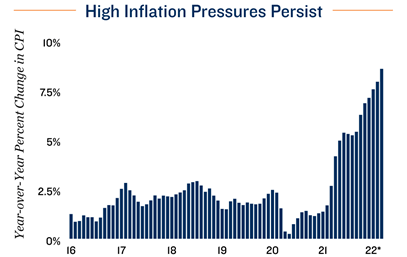

Inflation pressures persist. The Consumer Price Index increased by another multidecade high margin in March as multiple factors drive ongoing upward price movements. The widespread economic shutdown in 2020 led to unprecedented levels of fiscal stimulus, engorging the money supply, while the Federal Reserve also boosted liquidity by cutting lending rates and offering new programs. Aided by this support, consumer demand leapt ahead of supply as the economy unevenly reopened, hindered by a logjammed global supply chain. This demand-supply imbalance extends to the labor market and is lifting wages, along with the prices of many goods and services, resulting in further cost pressure on businesses. An ongoing housing shortage is also driving up the cost of homeownership, while conflict in Eastern Europe is disrupting energy markets. The Fed is signaling aggressive policies to combat this inflation, but their measures will take time to manifest as the many underlying issues persist.

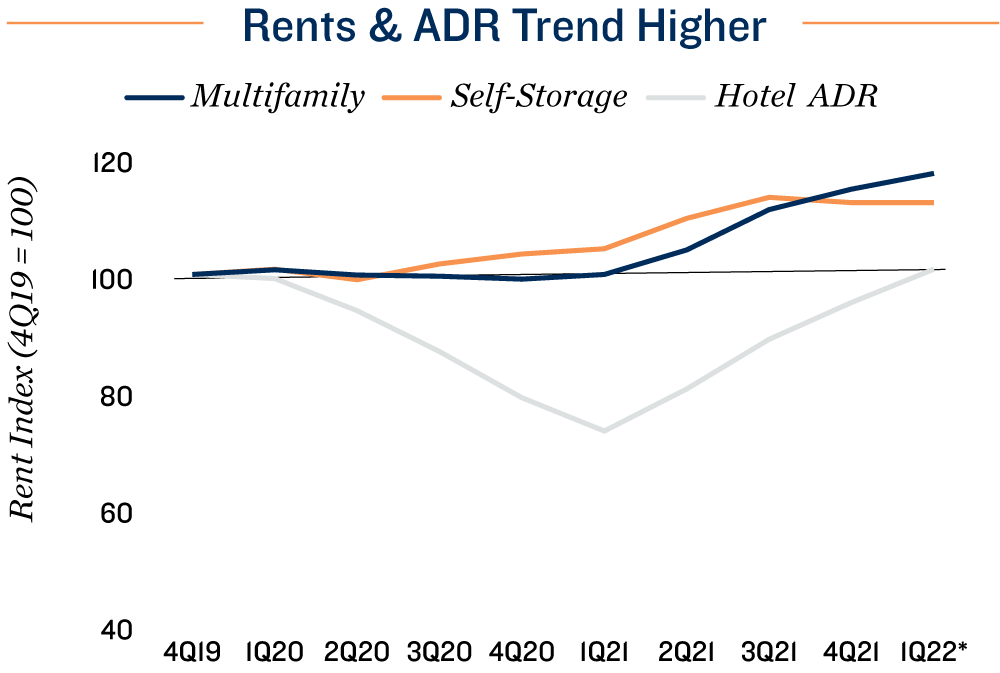

Climbing prices underscore prospects of multifamily investment.Hard assets like commercial real estate tend to retain their values during periods of high inflation better than most other alternative investment vehicles. Property types, such as multifamily, that are able to adjust rents more rapidly tend to be the most inflation resistant. The typical lease term on an apartment is 12 months, at which point rents can be realigned with market forces. Currently, those forces are driving monthly rates up at a rapid clip as the deepening housing shortage helped lift the average effective rent in the U.S. by 17.3 percent year-over-year in March. While growth varies market by market, overall, the sector is keeping ahead of inflation, which bodes well for investors.

Self-storage also demonstrating potential inflation resistance. Another sector with even shorter lease terms than apartments is self-storage, where units are typically rented monthly. After contending with years of oversupply, the pandemic instigated a swell of renter demand that dropped vacancy to a more than 20-year low last year. Tight availability lifted asking rents in turn, up 8.5 percent in 2021. While street rates did not climb notably in the first quarter of this year, the aging of the baby boomer and millennial generations support a robust long-term demand outlook for the sector.

Hotel room rates rapidly rising. The sector with the most rapid turnover is lodging, where hotel rooms are effectively rented on a nightly basis. While this feature can be a benefit during periods of high inflation, the sector has faced ample challenges over the past two years; however, dynamics are improving. The national occupancy rate has climbed back to within 10 percent of pre-COVID-19 levels. Average daily rates have ascended even more quickly, with the trailing 12-month mean returning to the 2019 mark in March. Given that ADR traditionally lags occupancy in recovery, this quick turnaround bodes well for the sector’s ability to address some inflation-related dilemmas this year.

*CPI as of March; Preliminary values for Self-Storage asking rent and Hotel ADR

Sources: Marcus & Millichap Research Services; Bureau of Labor Statistics; CoStar Group, Inc.; Federal Reserve; Moody’s Analytics; RealPage, Inc.; Radius+; Yardi Matrix

Randolph is a Multifamily Investment Sales Broker with eXp Commercial servicing Multifamily Buyers and Sellers in the Greater Chicago Area.